Submitted by Johnson Firm on

Your parent is getting on in age, but you don't have a clear idea if there is a plan in place for their care. It is a difficult topic to broach; no one wants to talk about death and the financial realities that come with aging. Instead of having a proactive conversation early in a parent's aging process most families have a reactive discussion under high levels of stress and emotions while their parent is experiencing an adverse health event. The Public Broadcasting Service (PBS) has reported that 85 percent of time long-term care decisions are made during a medical crisis. The message is clear, be proactive and start discussing the important financial questions with your parent.

Prepare Yourself

Your parent will be feel more comfortable and at ease if you have processed your feelings before talking to them. Conduct research so that you are knowledgeable enough to present a clear and concise set of options for your parent. Having options allows your parent and family to make decisions and feel in control of the process. You are seeking progress, not perfection. It may not all become settled in one conversation, but the price of silence about your parent's plan may be very costly to you.

Review Documents

Two of the most critical personal legal documents are a durable power of attorney (DPOA) and a healthcare proxy. All older adults should have these documents as it gives legal authority to a designated representative to make financial, legal, and health care decisions on your parent's behalf. If your parent does not have a DPOA and becomes incapacitated, you will have to go to court to get appointed as your parent's guardian which can be a complicated legal process at a time when your energy is better spent in the care and decision making for your parent. If they do not have a DPOA and health care proxy in place make arrangements for them to meet with a trusted elder law attorney to properly draft the legal documents.

Often a parent will have a will, retirement account information and insurance policies that have not been revisited or updated in years, sometimes decades. When was the last time your parent reviewed beneficiary designations? Family circumstances change, and the birth of a child, death or divorce can affect how your parent may want beneficiaries designated. It is best to review financial and insurance data annually with your parent and make adjustments if necessary. For example, if the parent's children are grown it might be best to cut back on the amount of life insurance they carry to save money on annual premiums.

Long Term Care Plan

Address the issue of long-term care. According to the PBS, a full 70 percent of all seniors will need some long-term care as they age. Even if your parent is healthy today odds are they will require long-term care and the costs are staggering. Some life insurance companies will add a long-term care rider to an existing policy. Medicaid also can cover some long-term care costs, but neither standard health insurance nor Medicare will cover your parent's long-term care expenses.

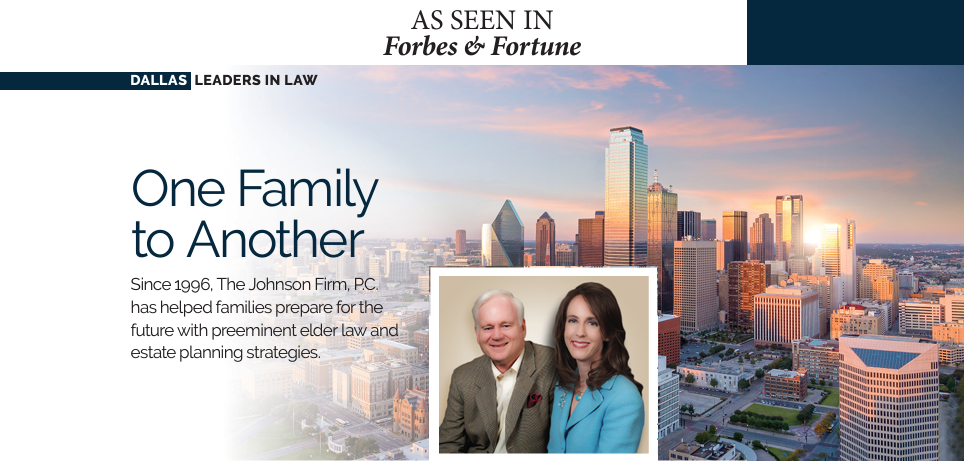

Discussing your parent's strategy is best begun while they are healthy. Proactive planning is the best way to help your family as your parents age. Contact our office today and schedule an appointment to discuss how we can help you and your family.