Choosing the right entity for your business is an important decision. While it is important to consider how certain structures will impact your day-to-day operations, it is also wise to think about how an entity can affect your long-term goals, including estate planning.

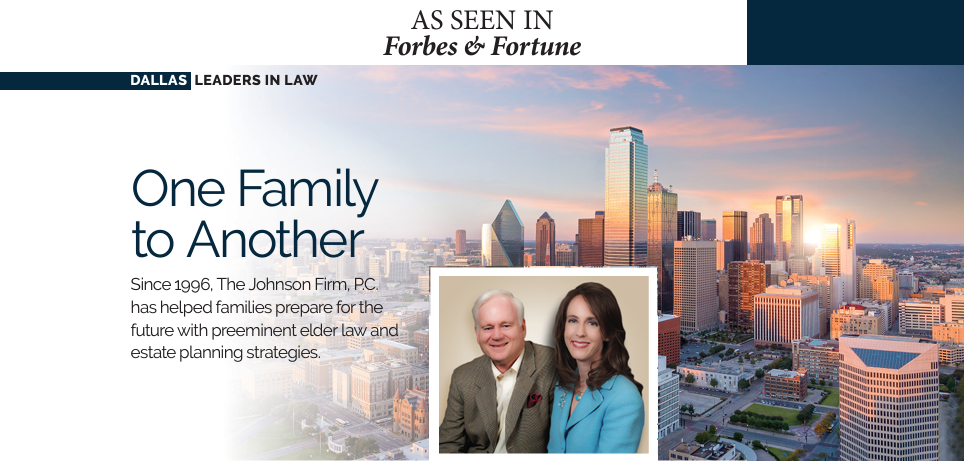

Limited liability companies (LLCs) provide important protection for small businesses and offer numerous estate planning benefits. At The Johnson Firm, P.C., we have helped many small-business owners establish LLCs that support their estate planning goals.

What Are The Benefits Of An LLC?

There are numerous benefits to structuring your business as an LLC. They include:

- Protecting your assets from creditors

- Simplifying the transfer of wealth to family members

- The ability to gift membership interest to your children

- Centralizing management of your company

As you can see, LLCs are worth considering if you own a small business. When you meet with us in your first consultation, our attorneys can explain in great detail what other benefits an LLC will offer in your specific situation.

Why Skill And Experience Matter When Establishing An LLC

Would you trust the future and well-being of your business to someone who does not have an in-depth understanding of the process of protecting it?

Incorrectly establishing a limited liability company can create serious headaches down the road and put your business assets in jeopardy. Our attorneys have years of combined legal experience. We know what it takes to protect your family and your assets, and we do not take it lightly. We can ensure that your LLC is properly established so you reap the benefits. Is your business worth more than a do-it-yourself online form?

Talk To Our Attorneys In An Initial Consultation

Start learning how to protect your most precious assets. Call us at (972) 299-3488 or send us an email to schedule your first consultation.