Individual retirement accounts represent a significant portion of many individuals' asset portfolios. Without proper protection in place, however, your IRA could be significantly diminished by unforeseen circumstances.

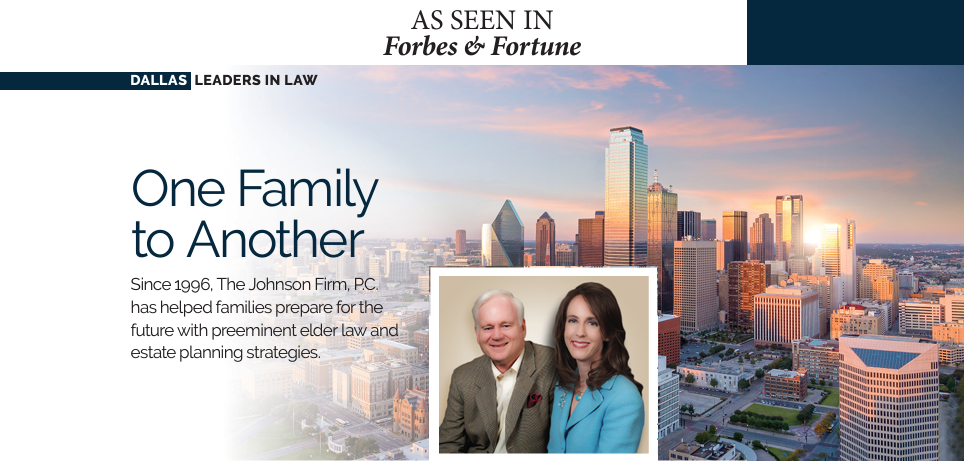

At The Johnson Firm, P.C. in Richardson, Texas, our experienced attorneys can assist you in preserving your hard-earned IRA for your heirs. We are a family firm, and we care about making sure your family is protected.

What Is An IRA Trust?

An IRA trust is a the trust that your IRA can be transferred into upon your death. Essentially, the trust is a beneficiary of your IRA. Once it is established, you can set the terms of the trust, including determining who will benefit from it and how. It allows your IRA to be transferred directly to your beneficiaries. It is also a living trust, meaning you can change the terms as you wish during your life.

What Are The Benefits?

Passing on your IRA in a trust ensures that it is protected for your heirs later on. For example, an IRA trust is shielded from creditors if your heirs ever need to file for bankruptcy. It may also protect your beneficiaries if they get divorced, as an inheritance trust is off limits in a divorce. It can also help you control how much of the IRA heirs who are minors can access over time. It can also ensure that your grandchildren, and not someone else's grandchildren, receive the benefit if your child dies.

How We Can Help

Setting up an IRA trust can be a complicated process, and it is important that it be handled properly. One mistake could mean all your efforts were for nothing.

Our estate planning attorneys have years of combined experience. We have helped many clients set up successful IRA trusts. We will use our skill and experience to ensure that your assets are safe and secure.

Ask Us About IRA Trusts In Your First Consultation

To arrange a time to discuss IRA trusts with one of our attorneys, please call us at (972) 299-3488 or request an appointment online.