If you have a loved one who lives with a disability, ensuring that he or she is provided for — whether you are around or not — may be a priority for you. An effective way to ensure financial stability is to establish a special needs trust.

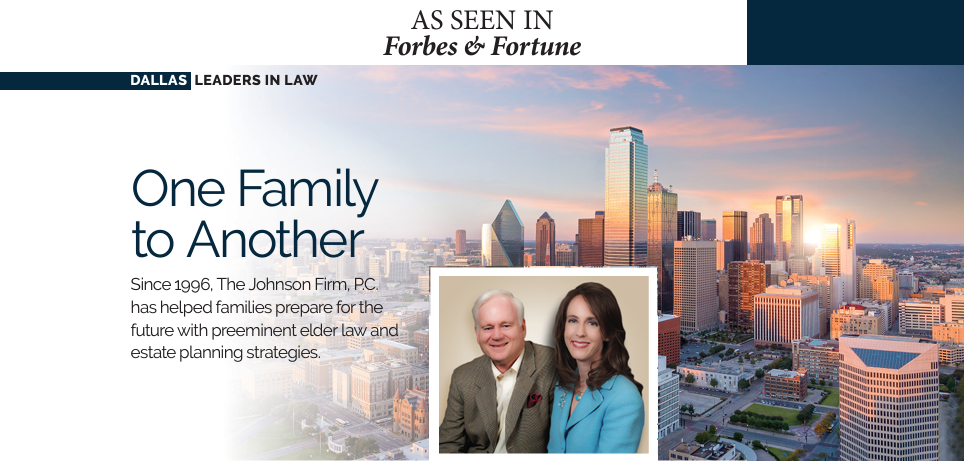

At The Johnson Firm, P.C. in Richardson, Texas, we are passionate about helping individuals and families protect the futures of their loved ones. Our estate planning attorneys can help you maximize your efforts to provide for your disabled loved one through a special needs trust.

What Is A Special Needs Trust?

A special needs trust allows you to financially support a loved one with a disability without jeopardizing his or her access to government benefits. The contents of the trust are often administered through a third party to the beneficiary — your loved one.

What Benefits Do They Provide?

Special needs trusts provide numerous benefits to the beneficiary of the trust as well as the person who established the trust. They include:

- Retention of government benefits: Many people with disabilities rely on government services to get the medical and financial assistance they need. A special needs trust allows them to receive additional funds without losing their benefits.

- Stability and support: By creating a special needs trust, you allow your loved one to maximize his or her financial stability. Extra financial support can help pay for important care and other necessities not covered by government benefits.

- Peace of mind: The benefits of a special needs trust extend to the creator of the trust as well. You can rest easy knowing that your loved one will be cared for, no matter what happens to you.

Why A Financial Gift Does Not Help In The Same Way

If you are wondering why you cannot simply give your loved one a sum of money, the answer to that lies in government benefits. Eligibility for government benefits is typically based on income and assets. If your financial gift raises your loved one's total assets above the government threshold, he or she will likely lose those benefits.

Special needs trusts, when properly drafted, are not counted when determining assets for government benefits. This allows the recipient of the trust to continue to receive important services while still benefiting from your gift.

Protect Your Loved One. Call Us Today.

We are ready to help you put important protections in place for your loved one. Are you ready to get started? If so, please call (972) 299-3488 or contact us via email to schedule an appointment with one of our attorneys.